How Nest works

Nest is Plume's flagship RWAfi permissionless protocol enables

anyone to earn institutional-grade yields from real-world assets.

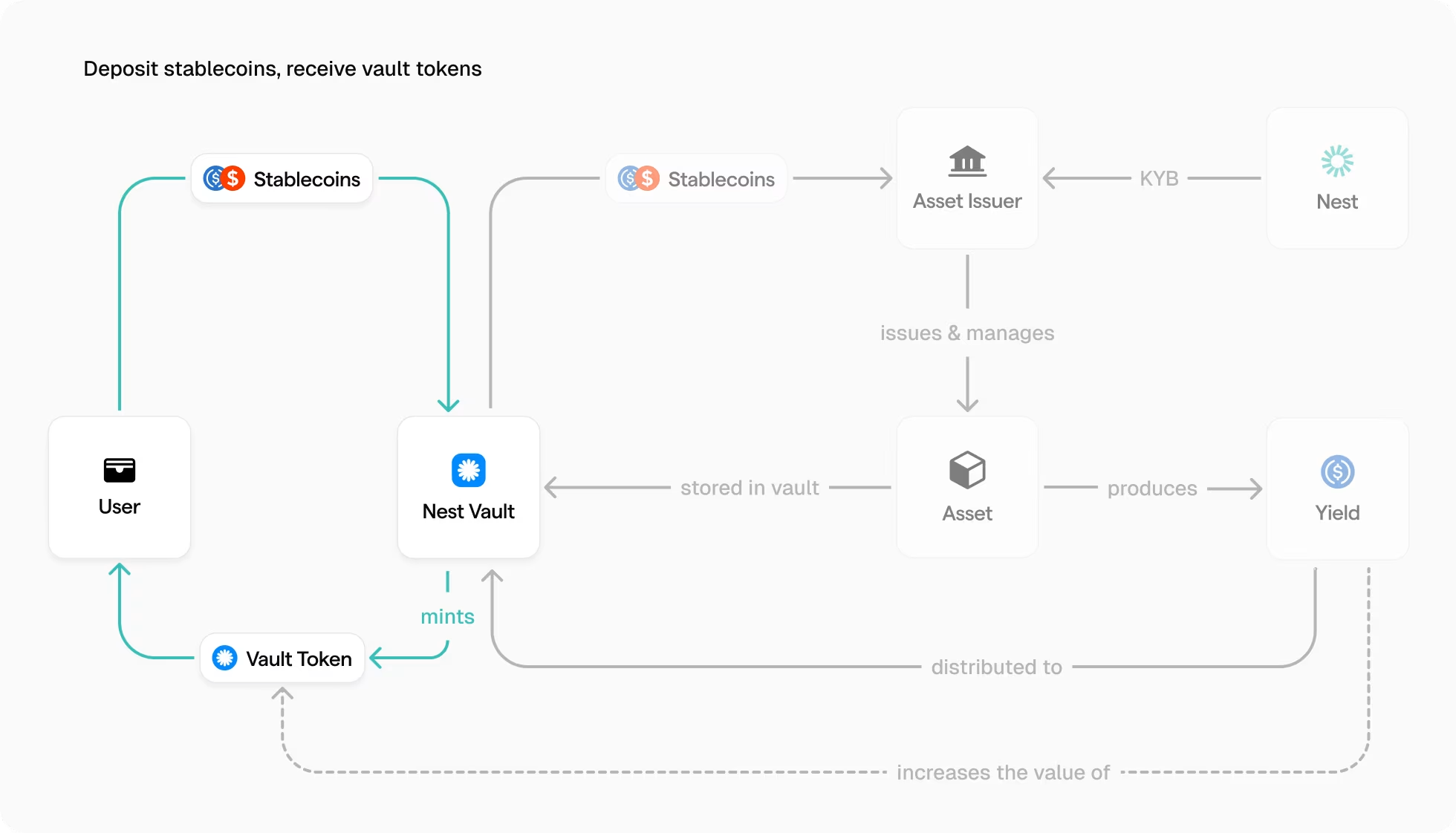

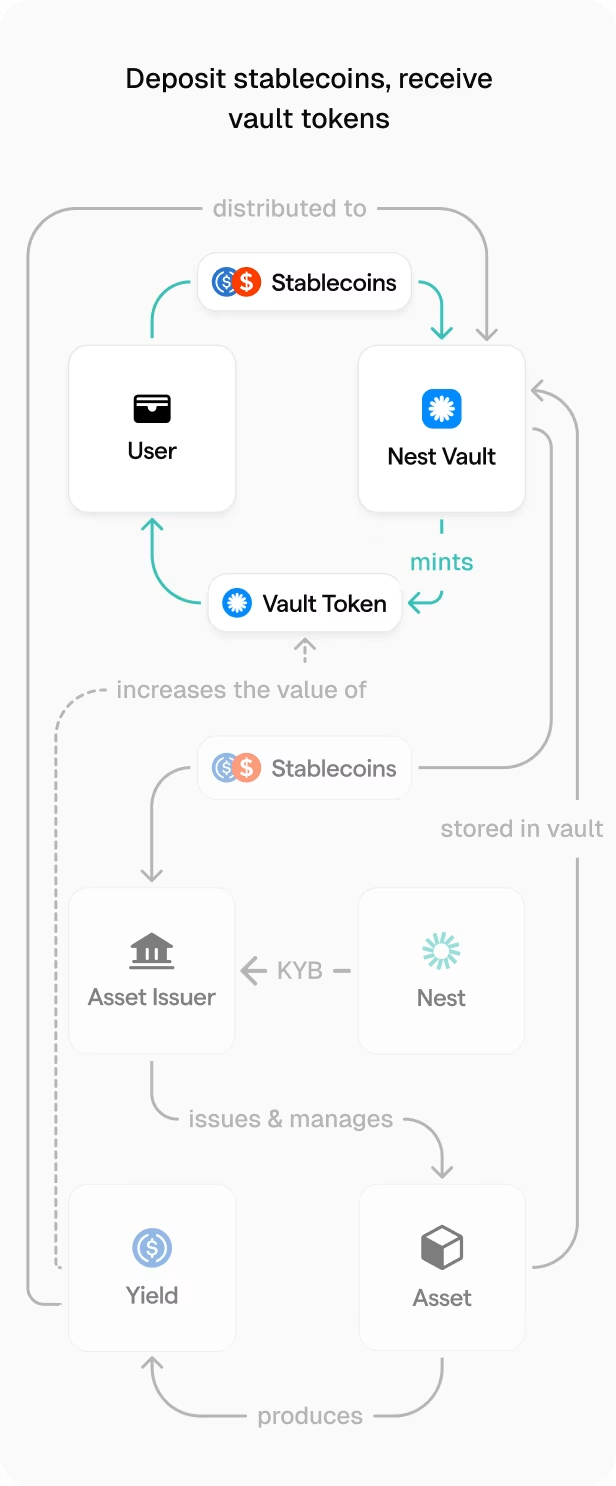

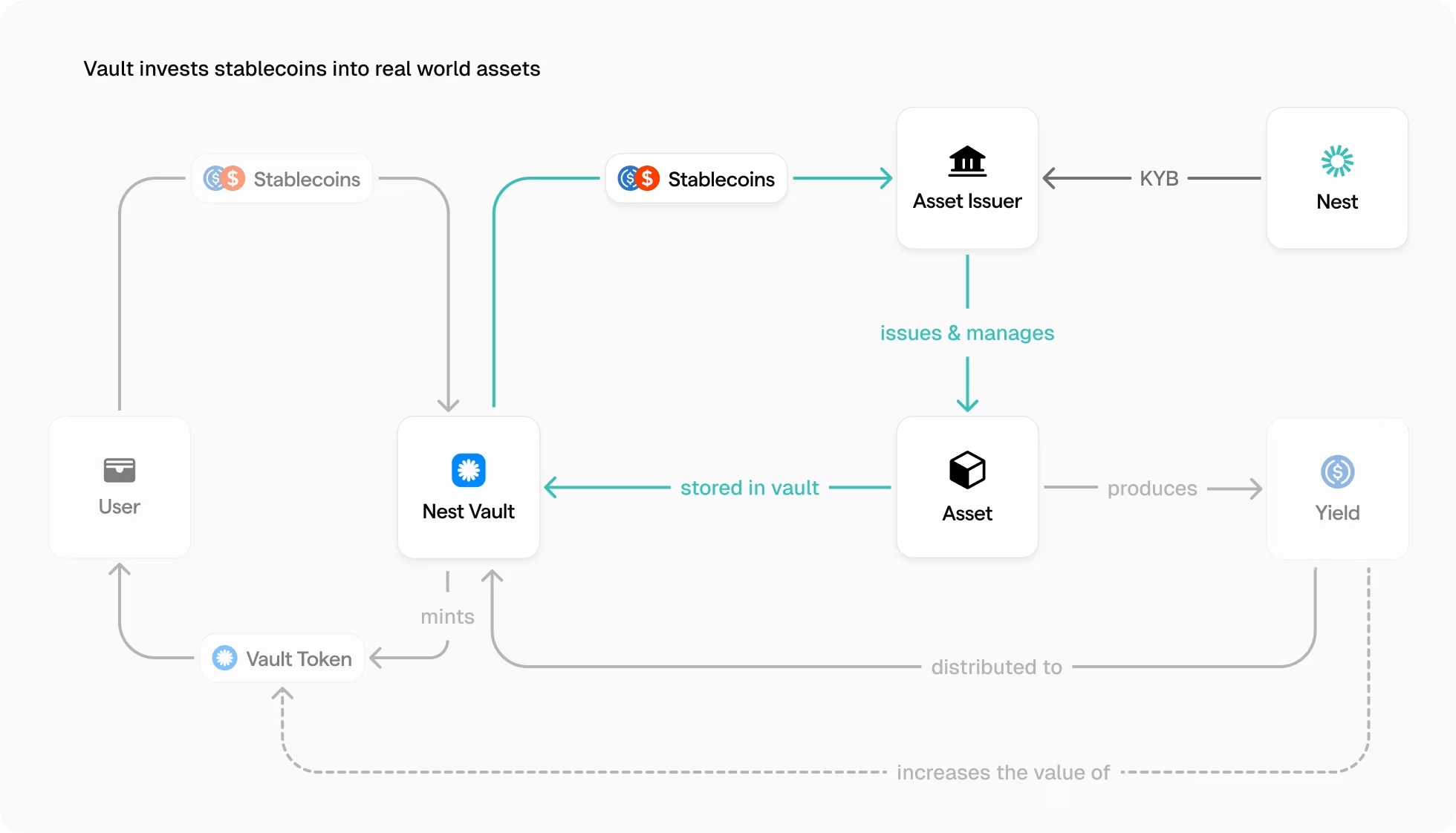

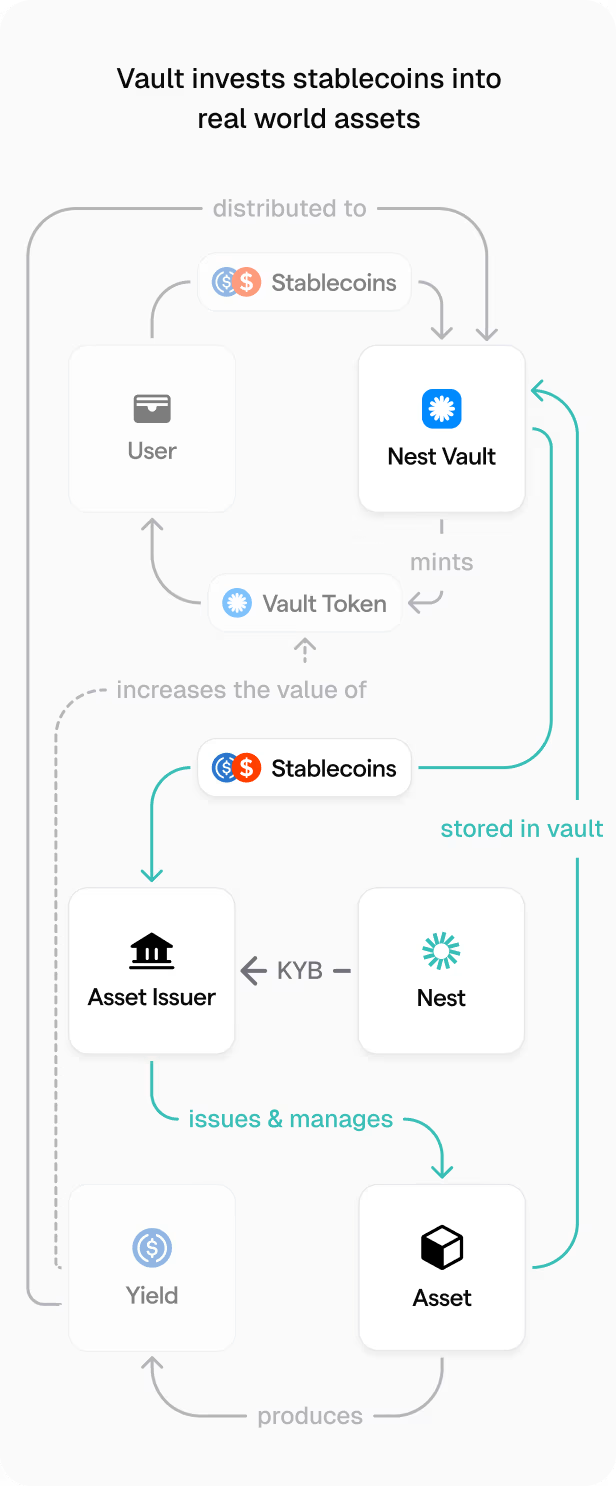

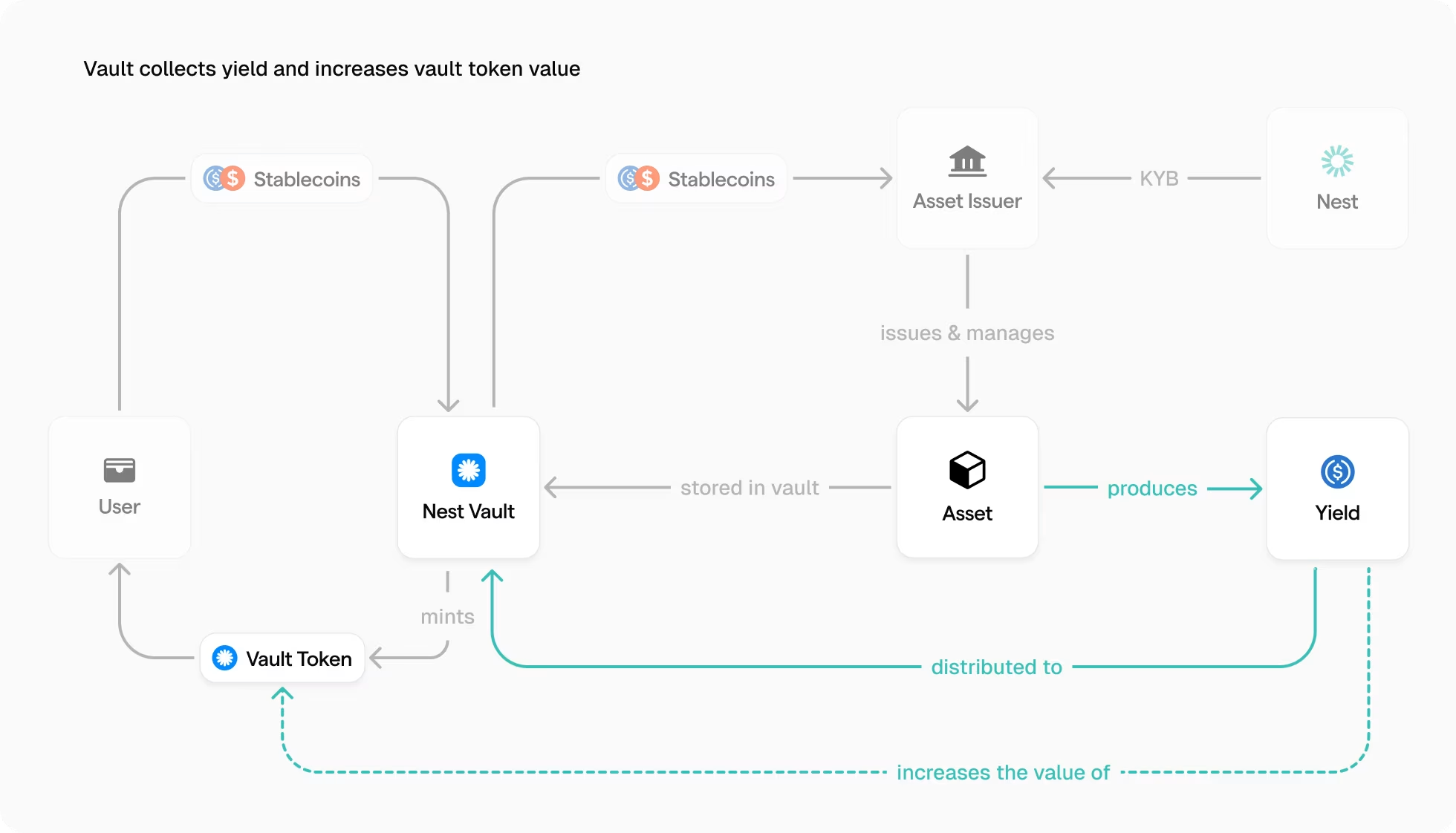

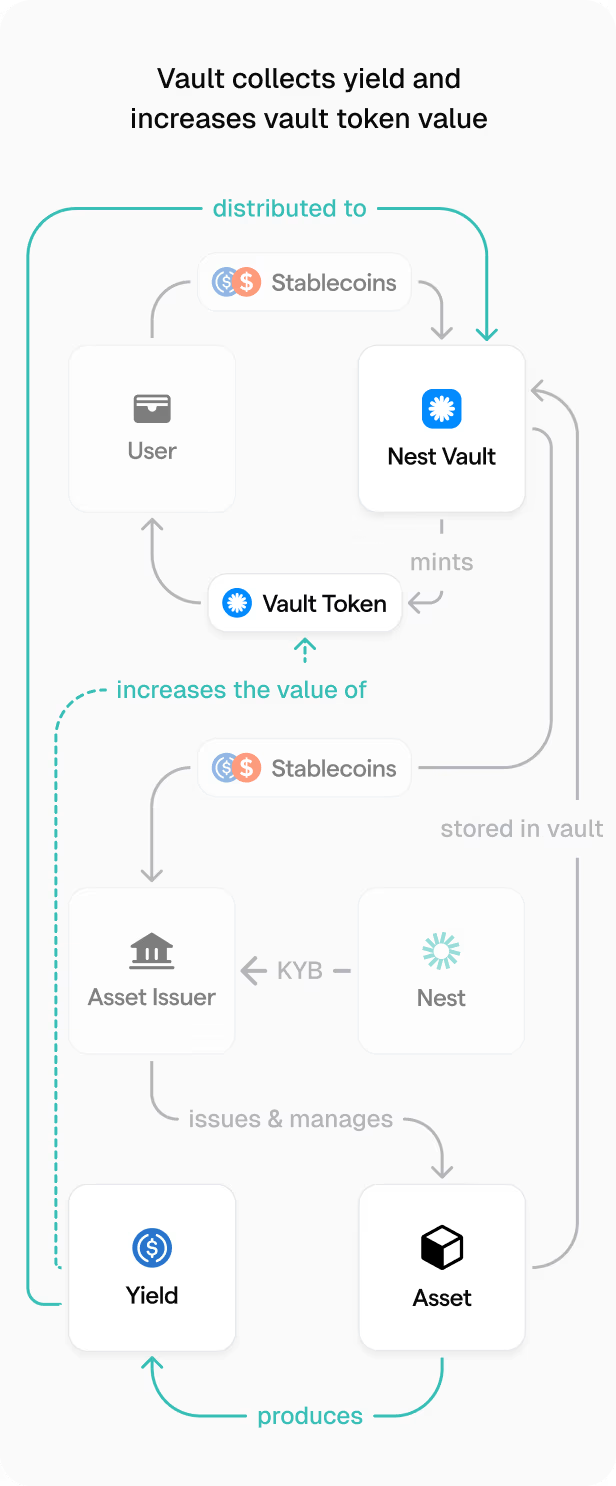

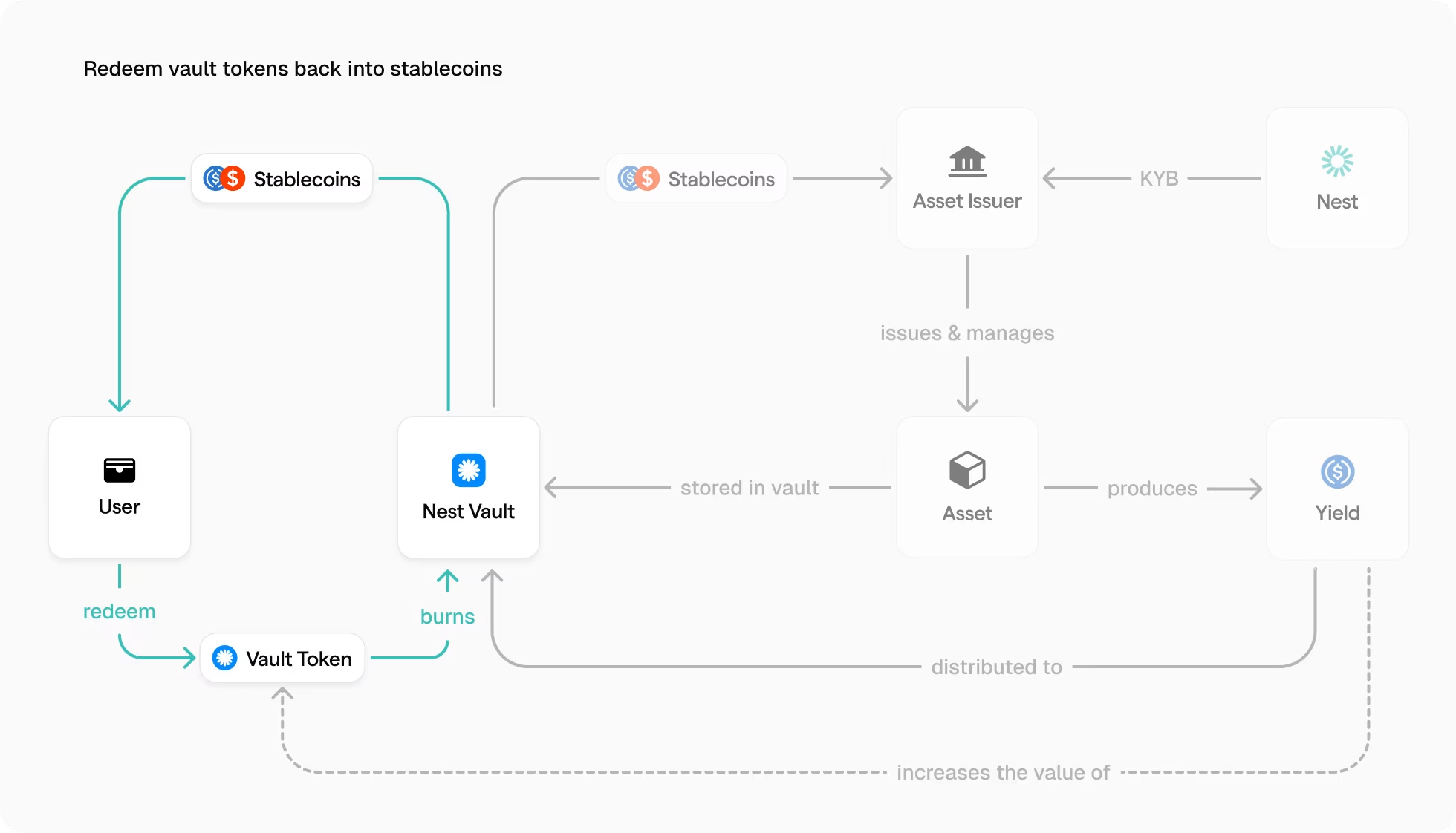

Flow of Funds

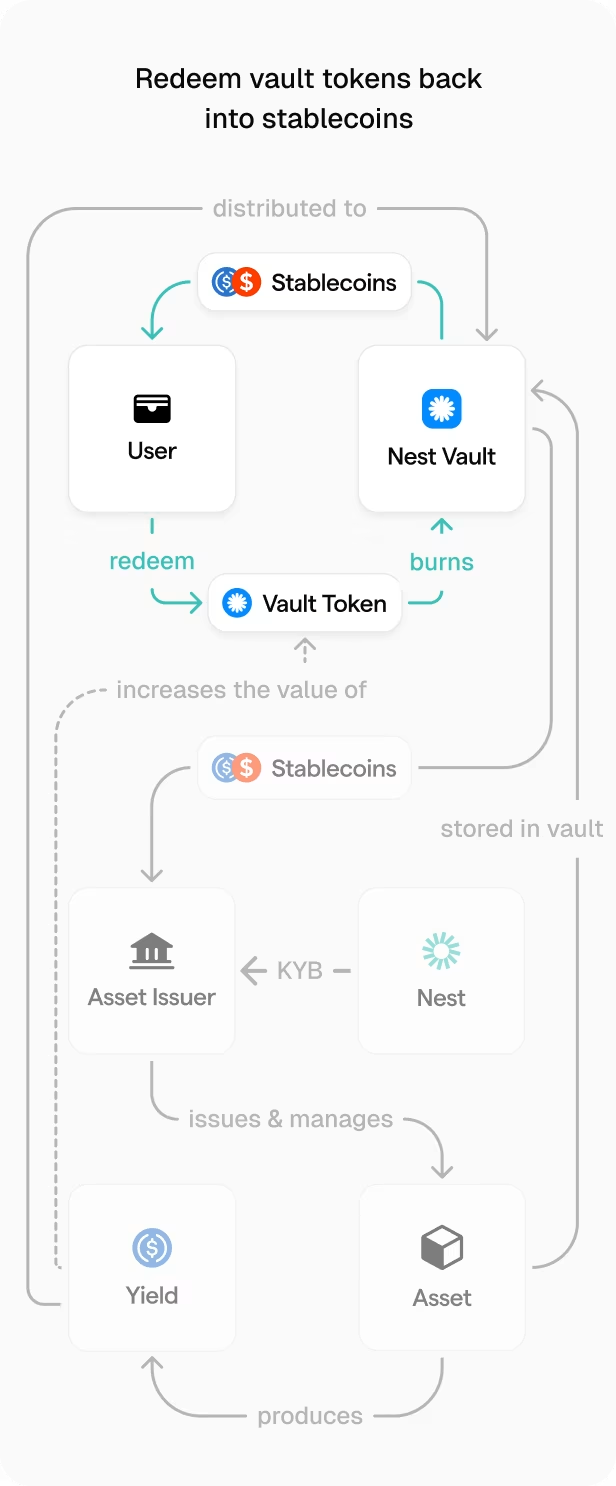

Nest Protocol is the primary interface that allows Real World Assets to be tokenized to yield-bearing tokens. Users can deposit stablecoins to receive real world yield via Nest vault LP token, and use the LP token seamlessly across Plume's RWAfi ecosystem.

Step 1

Deposit stablecoins

Step 2

Vault invests into RWAs

Step 3

RWAs generate yield

Step 4

Withdraw stablecoins

Risk Management

Plume's institutional credit underwriting team, Cicada Partners, has over 35 years of experience in traditional and on-chain credit markets, successfully underwriting over $1B+ in loans. Cicada Partners is responsible for conducting due diligence on the managers, assets, and curation of products through Nest.

Organization

Cicada Partners

Website

Cicada Partners is a specialist credit and advisory firm focused on institutional stablecoin financing and the modernization of traditional lending. They provide end-to-end services for the origination, underwriting, and structuring of real-world asset offerings, combining deep credit expertise with next-generation tools like wallet infrastructure and AI-powered underwriting. Cicada empowers institutions to deploy capital into safer, smarter lending strategies using stablecoin rails.

- Co-Founder of Orthogonal Credit

- Director of Credit, abrdn

- Credit at Loomis Sayles and Standard Life Investments

- Corporate Banking IBCB, BNP Paribas, Deutsche Bank

- Certified Financial Risk Manager (FRM®)

- Masters, London School of Economics

Director of Credit

Christian Lantzsch

- Co-Founder of Orthogonal Credit

- Leveraged Finance at PNC

- Masters in Blockchain at Nicosia

- BS University of Southern California

Risk management methodology

Cicada's full risk management methodology can be studied below, including but not limited to the below scorecard parameters

Asset Quality

Liquidity

Diversification

Currency Risks

Counterparty Quality

Capital

Leverage

Security

Capital Structure

Stickiness of Capital

Quality of Business

Track Record

Burn Rate

Business Strategy

Complexity

Management

Quality of Data/Reporting

Skin in the Game

Transparency

Reputation

Proprietary scoring system 1-5 scale

HoldCo/SPV lending requires a minimum borrower score of 3.0 CCR

AAA = 5.0-4.2

BBB = 4.1-3.9

BB- = 3.8-3.3

Security

Each vault has detailed information containing financial disclosures and agency ratings. Issuers are required to present third-party financial audits to include their assets in Nest vaults.

Regulated Asset Custodians

Assets are held by regulated custodians, including Coinbase Prime, Alpaca Markets, Anchorage Digital and others.

World-Class AML

Best-in-class sequencer-level controls powered by TRM, Elliptic and Chainalysis to remove malicious actors at the root.

Smart Contract Audits

All Nest smart contracts are audited by leading crypto security firms.